Affected by spa closures? Collect your insurance payouts if you have prepayments with any of these 28 CaseTrusted spas

CASE calls for consumers affected by spa closures to collect insurance payouts

- More than $169,000 in prepayment protection insurance payouts under the CaseTrust accreditation scheme for spa and wellness businesses are unclaimed as affected consumers could not be contacted despite efforts to reach them.

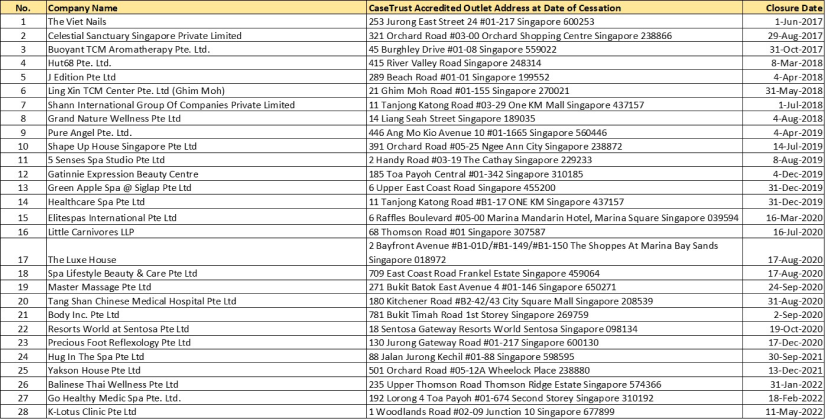

- The sum is part of the payout due to consumers affected by the closure of 28 CaseTrust accredited spa and wellness businesses between February 2017 and June 2022.

- More than $280,000 had been paid out under the scheme to 512 affected consumers since 2017, with an average of approximately $540 paid out to each consumer. Approximately 580 consumers could not be contacted or had not responded to CaseTrust’s appointed insurer, AVA Insurance Brokers Pte Ltd (“AVA Insurance”) to collect the $169,000 in unclaimed payouts.

- The Consumers Association of Singapore (“CASE”) urges these affected consumers to contact AVA Insurance at [email protected] or 6535 1828 for more information on collecting their payouts. Claims must be submitted to AVA Insurance within six years of the business closure.

- As at 13 July 2022, the amount of consumer prepayments insured under the scheme stands at more than $15.8 million. The cumulative amount of prepayments protected since the introduction of the prepayment protection feature in the scheme stands at more than $263 million.

Background

CASE is concerned with the loss of consumer prepayment due to sudden business insolvency as it is generally challenging for consumers to recover their prepayments.

To safeguard consumers from losing their prepayments in spa and wellness packages, CASE introduced prepayment protection in the CaseTrust spa and wellness accreditation scheme in 2011. Spa and wellness businesses accredited under the CaseTrust scheme are required to protect prepayments made by consumers via the purchase of prepayment protection insurance.

Upon making prepayment to a CaseTrust accredited spa and wellness business, consumers would be given an insurance certificate listing their personal details and the protected sum. In the event the spa suddenly closes down, AVA Insurance Brokers Pte Ltd (AVA Insurance) will contact the affected consumers to collect their insurance payouts.

How to Collect

To collect their payouts, consumers can contact AVA Insurance at Email: [email protected] or Tel: 6535 1828 and provide their insurance certificate number. Consumers who have lost or misplaced their insurance certificates will need to provide their National Registration Identity Card (NRIC) number for verification.

List of 28 CaseTrust accredited spas which closed between February 2017 and June 2022