CPFTA & Lemon Law

Consumer Protection (Fair Trading) Act

The Consumer Protection (Fair Trading) Act (CPFTA) was enacted to protect consumers against unfair business practices after years of advocacy by CASE and its Fair Trading Legislation Committee. The CPFTA accords the right to consumers to seek civil redress against suppliers engaging in unfair business practices.

It is our firm belief that we need fair trading legislation to promote a fairer and more equitable marketplace. Such legislation would protect both consumers and businesses by making the playing field more levelled.

In 1979, the late Mr Ivan Baptist, the then President of CASE, first urged the government to consider fair trading legislation in Parliament. After years of a feasibility study, the CPFTA was passed in Parliament on 11 November 2003 and took effect on 1 March 2004.

Through the years, CASE has worked closely with the Ministry of Trade and Industry (MTI) to periodically revise and update the CPFTA to ensure that it remains relevant.

Alternatively, you can purchase a copy from the CASE office at $3.27 (incl GST)

Administering Agency of CPFTA

In September 2016, the CPFTA was further amended to strengthen the existing measures that may be taken against errant suppliers who persist in unfair trading practices. Under the amended CPFTA, SPRING Singapore was appointed as the administering agency with investigative and enforcement powers, which includes:

- Gathering evidence against persistently errant suppliers; and

- Filing injunction applications with the Courts; and

- Enforcing compliance with injunction orders issued by the Courts.

With effect from 1 April 2018, the Competition and Consumer Commission of Singapore (CCCS) took over the administration of the CPFTA. CASE and the Singapore Tourism Board remain the first points of contact for local consumers and tourists respectively to handle complaints. Errant suppliers who persist in unfair trade practices will be referred to CCCS for investigation.

While the CPFTA gives consumers the right to seek recourse, consumers should still be vigilant in protecting their own interests by exercising due care when buying goods and services.

Unfair Practices under CPFTA

The following practices in relation to consumer transactions have been identified as unfair practices under Section 4 of the CPFTA. These include suppliers who:

- Do or say anything, or omit to do or say anything, if as a result a consumer might reasonably be deceived or misled; and/or

- Make a false claim; and/or

- Take advantage of a consumer if they know or ought reasonably to know that the consumer:

- Is not in a position to protect his own interests; and/or

- Is not reasonably able to understand the character, nature, language or effect of the transaction or any matter related to the transaction; and/or

- Commit any of the 24 unfair practices specified in the Second Schedule to the CPFTA

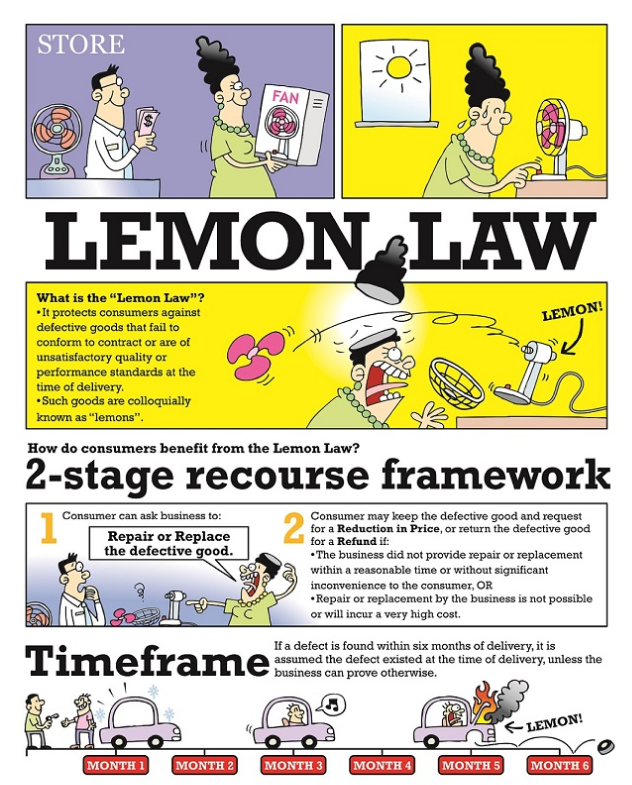

Lemon Law

CASE did not rest on its laurels after the CPFTA was passed and continued to push for consumer protection. One problem was that there was little protection for consumers regarding defective goods—this spurred CASE to advocate for the Lemon Law, enacted in 2012. Under the Lemon Law, consumers have the right to request repair, replacement, reduction in price or rescission of contract for goods that do not conform to the contract.

The provisions of the Lemon Law can be found in Sections 13 to 18 of the CPFTA

Buying a used car? Be sure to download the

SAFE Checklist

Coverage of the Lemon Law

- The Lemon Law covers all general consumer products purchased in Singapore (e.g. apparel, stationery, electronics, furniture, motorcars, etc). It does not apply to houses, land or rental/leased goods.

- Second-hand goods and vehicles are included but “satisfactory quality” would take into account their age at the time of delivery and the price paid.

- The Lemon Law does not apply to services.

- It does not apply to business-to-business and consumer-to-consumer transactions.

Consumers are not entitled to remedies under the Lemon Law if

- The consumer had damaged the item.

- The consumer had misused the item and caused the fault.

- The consumer had tried to repair the item himself or had someone else try to repair it, and in the process damaged it.

- The consumer had been told about the fault before he bought the item.

- The consumer had changed his mind and no longer wanted the item.

- The fault is due to wear and tear.